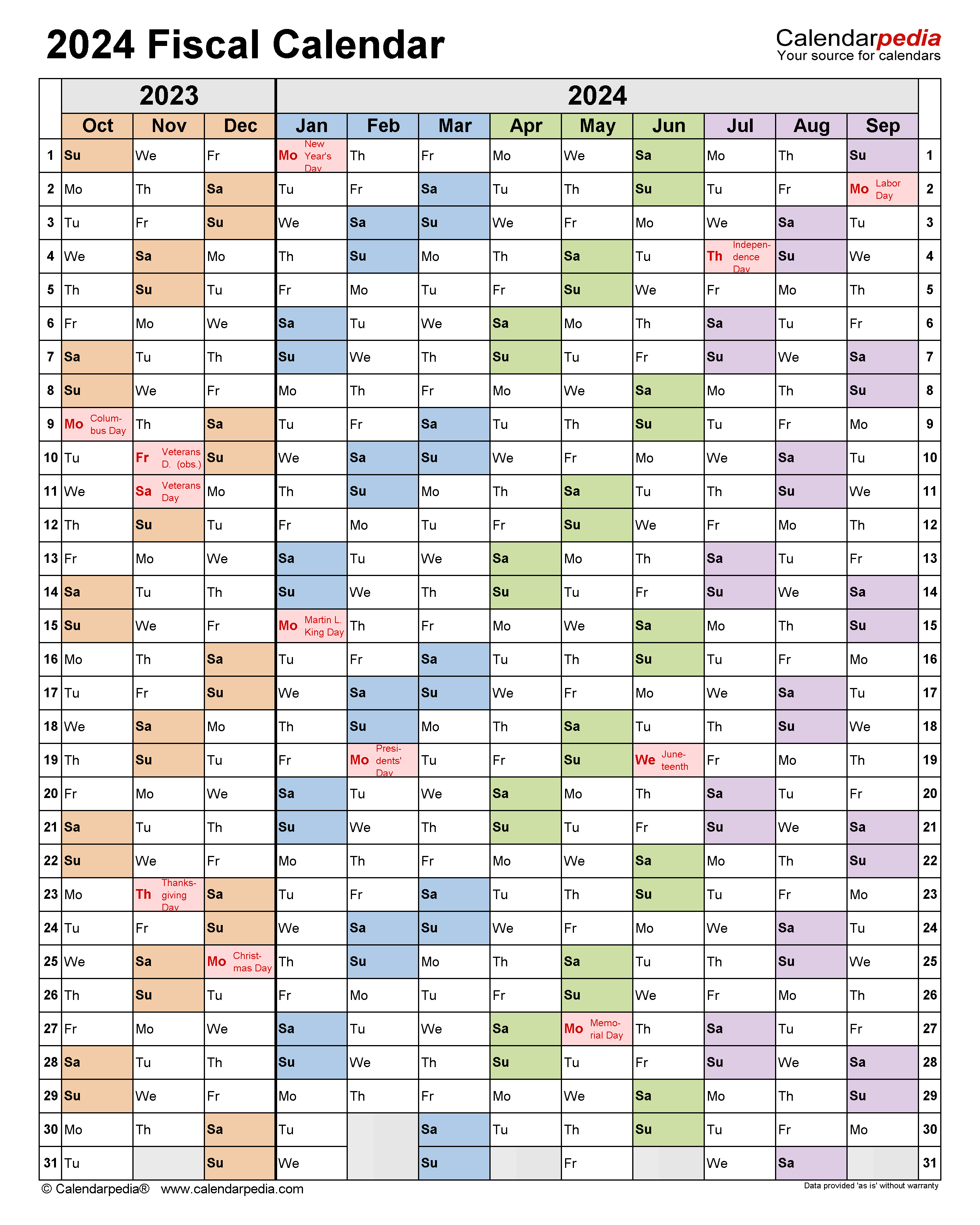

Bas Due Dates 2024 Tax Agent Login. Extended due date with a tax agent: Find out how to lodge online, reduce bas payments, and avoid penalties.

Learn how to use online services for agents, standard business reporting (sbr) and the practitioner lodgment service (pls) to prepare, lodge and revise activity statements and. Learn how to apply for registration as a bas agent with the tpb, the government agency that regulates tax practitioners in australia.

Bas Due Dates 2024 Tax Agent Login Images References :

![BAS Due Dates [2023 2024] All The Info You Need In 1 Place BAS Due Dates [2023 2024] All The Info You Need In 1 Place](https://creditte.com.au/wp-content/uploads/2022/02/BAS-due-dates.jpg) Source: creditte.com.au

Source: creditte.com.au

BAS Due Dates [2023 2024] All The Info You Need In 1 Place, Learn the key tax due dates for business activity statement (bas), payg, and tax return deadlines with.

Source: jessicawmoyra.pages.dev

Source: jessicawmoyra.pages.dev

Monthly Bas Due Dates 2024 Irs Elie Nicola, These will be issued with a deferred due date of 21 february.

Source: jonieqbeverlie.pages.dev

Source: jonieqbeverlie.pages.dev

Monthly Bas Due Dates 2024 Opm Naomi Virgina, Find lodgment and payment due dates for tax and superannuation obligations for registered agents.

Source: caroleqroselin.pages.dev

Source: caroleqroselin.pages.dev

2024 Tax Return Due Mindy Sybille, The due date for quarter 3 is 28 april 2024.

Source: kellybmalena.pages.dev

Source: kellybmalena.pages.dev

Bas 2024 Due Dates In Hindi Breena Terrie, Find out when to lodge and pay your business activity statement (bas) if you report gst quarterly.

Source: laraqzabrina.pages.dev

Source: laraqzabrina.pages.dev

Deadline For Filing 1099 With Irs 2024 Vonny, To log in, you'll need mygovid and relationship authorisation manager (ram).

Source: brisbanecentralbookkeeping.com.au

Source: brisbanecentralbookkeeping.com.au

BAS Lodgement Due Dates for Australian Small Businesses (2021, If you’re eligible for annual reporting, your bas for the full 2024 financial year is due by february 28, 2025.